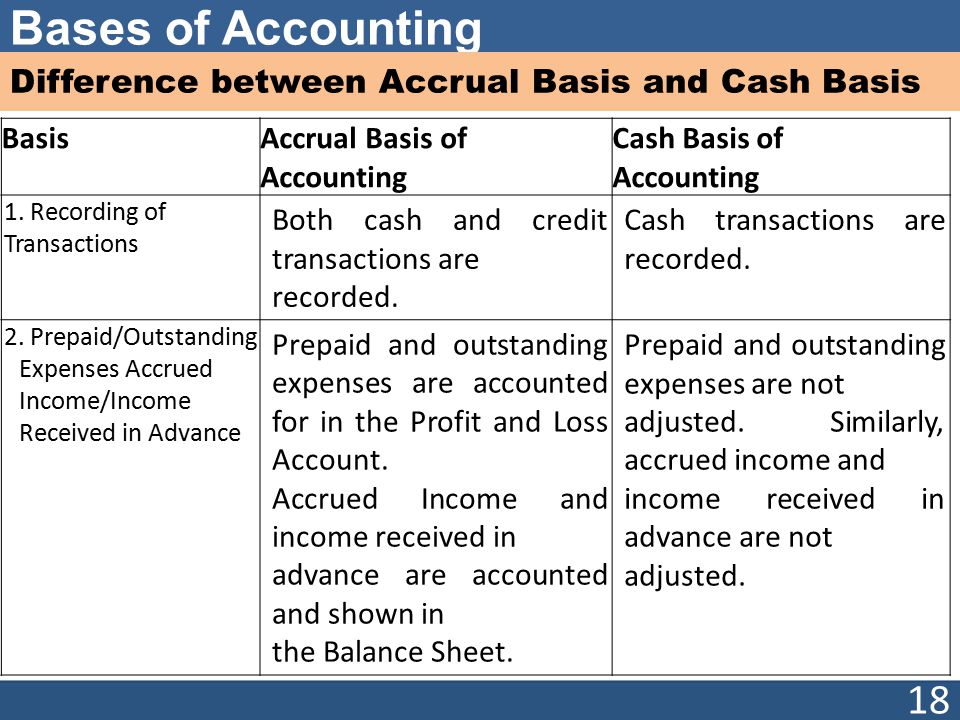

Thank you for reading CFI’s guide to the Bookkeeping Process. Video Explanation of the Bookkeeping Process Transaction recorded through an accounts payable (liability) account Record transaction when it occurs, even if cash is not received or paidĮxample: You purchased 100 units of a product and will pay for it next month. Bookkeeping is the process of recording your companys financial transactions into organized accounts on a daily basis. Record transaction only when cash is actually received or paid The difference between these types of accounting is based on the timing for when the company actually records a sale (money inflow) or purchase (money outflow) in the books. Companies can choose between two basic accounting methods: the cash basis of accounting or the accrual basis of accounting.

In order to properly implement bookkeeping, companies need to first choose which basis of accounting they will follow. One important thing to note here is that many people who intend to start a new business sometimes overlook the importance of matters such as keeping records of every penny spent.

#Bookkeeping meaning professional#

Instead, small companies generally hire a bookkeeper or outsource the job to a professional firm. Many small companies don’t actually hire full-time accountants to work for them because of the cost. In short, once a business is up and running, spending extra time and money on maintaining proper records is critical. It also provides information to make general strategic decisions and a benchmark for its revenue and income goals. Proper bookkeeping gives companies a reliable measure of their performance. The practice or profession of recording the accounts and transactions. Simply put, business entities rely on accurate and reliable bookkeeping for both internal and external users. Bookkeeping definition The work of keeping a systematic record of business transactions. Without bookkeepers, companies would not be aware of their current financial position, as well as the transactions that occur within the company.Īccurate bookkeeping is also crucial to external users, which includes investors, financial institutions, or the government – people or organizations that need access to reliable information to make better investments or lending decisions.

With proper bookkeeping, companies are able to track all information on its books to make key operating, investing, and financing decisions.īookkeepers are individuals who manage all financial data for companies. Bookkeeping involves the recording, on a regular basis, of a company’s financial transactions.

0 kommentar(er)

0 kommentar(er)